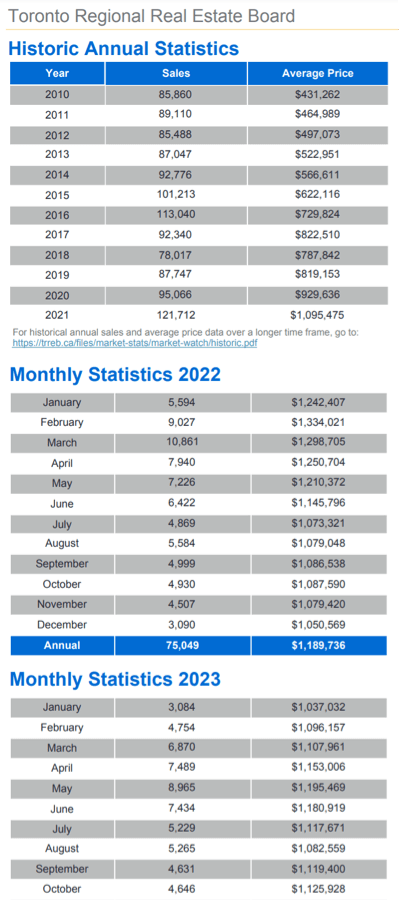

Toronto, Ontario, November 2, 2023 - “MarketWatch”, The Toronto Regional Real Estate Board’s monthly MLS® statistical update on the residential real estate market in TRREB’s market area - generally Metropolitan Toronto, the GTA / Greater Toronto Area, and the Greater Golden Horseshoe region of South-Central Ontario - was released this morning for October confirming what many already knew: Growing inventory combined with moderately lower sales volume and a slower rate of rise in the average selling price of homes.

Overall

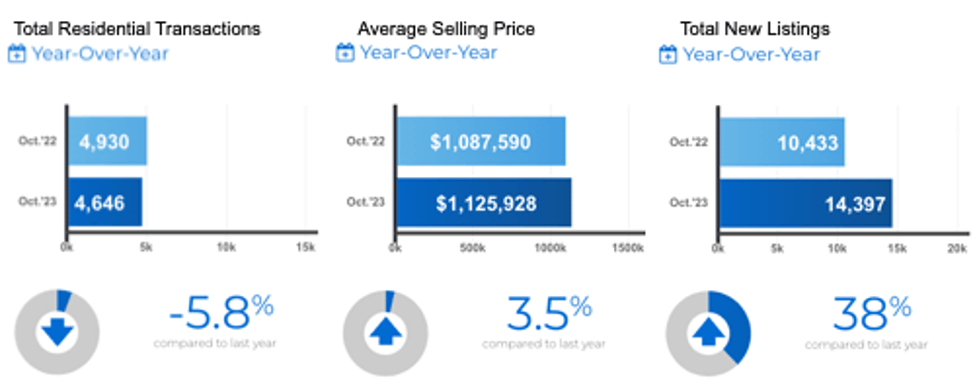

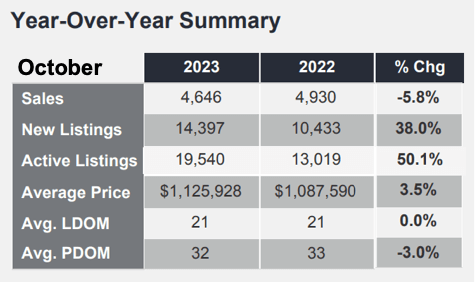

Including all of TRREB’s market area as noted above and all home types & styles, there were 4,646 sales reported in October, down 5.8% from last October. The overall average sale price was $1,125,928, up 3.5% compared to that year-earlier period.

All stats referenced herein are year-over-year [“YoY”] comparisons unless otherwise noted.

Specific Numbers by “Major Home Type

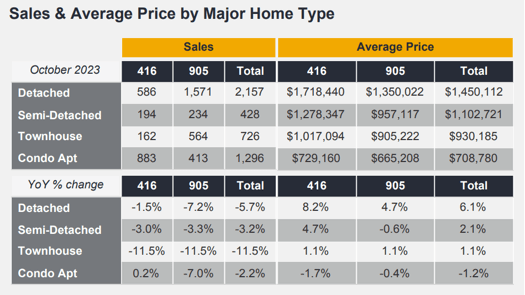

Metropolitan Toronto saw 586 Detached homes sell “firm” [e.g. unconditionally] on the month, relatively flat at -1.5%, averaging a sale price of $1,718,440, up a relatively strong 8.2%. In the rest of that TRREB market area 1,571 “Detacheds” were reported sold, down 7.2%,  averaging $1350,022, up 4.7%.

averaging $1350,022, up 4.7%.

Condo Apartments sales volume in “The Big Smoke” - Metro Toronto - came in at 883 for the month, virtually unchanged at +0.2%, averaging $729,160, off 1.7% YoY. The balance of the market area saw 413 Condo Apartments sell, down an even 7%, at an average of $665,208, again “all but flat” at -.04%.

On the Inventory Front

Well, it was a long time coming, but we’ve finally got some relief on the inventory of homes available for sale as we noted here last month.

The all-important “Total Active Listings” (TAL) stood at 19,540 as of month-end. That’s a hefty 50.1% rise from the year-earlier period. “New Listings” - which includes houses & condos terminated and re-listed - more and more often these days for price reductions as sales have slowed somewhat and inventory’s jumped - totalled 14,397 on the month, up 38%.

“Indicated Forward Inventory" gives us an idea of how long it would take to sell all the current listing inventory under the assumption that the current rate of sales remains constant. It’s calculated simply by dividing the TAL figure by the month’s sales total. That works out to 4.21 months. After a very long time of very tight inventory taking the definition of “Seller’s Market” to historical extremes, it’s suddenly higher than the historic norms. That should be great news for home buyers… but to what degree that impacts home prices obviously remains to be seen.

the current rate of sales remains constant. It’s calculated simply by dividing the TAL figure by the month’s sales total. That works out to 4.21 months. After a very long time of very tight inventory taking the definition of “Seller’s Market” to historical extremes, it’s suddenly higher than the historic norms. That should be great news for home buyers… but to what degree that impacts home prices obviously remains to be seen.

Interestingly, the homes that sold in October sold at the same “speed” this October as last at 21 Days on Market. That’s still pretty quick by historical standards. We’ll see if it stays that way with the higher inventory.

We’d also note that Bungalows across TRREB’s market area [and beyond, apparently] are still in high demand though supply of that popular home style remains quite constrained.

Quoting from the Report

TRREB’s Director of Market Analysis, Jason Mercer:

“Competition between buyers remained strong enough to keep the average selling price above last year’s level in October and above the cyclical lows experienced in the first quarter of this year. The Bank of Canada also noted this resilience in its October statement. However, home prices remain well-below their record peak reached at the beginning of 2022, so lower home prices have mitigated the impact of higher borrowing costs to a certain degree,”

TRREB CEO John DiMichele:

“In the current environment of extremely high borrowing costs, it is disappointing to see that there has been no relief for uninsured mortgage holders reaching the end of their current term. If these borrowers want to shop around for a more competitive rate, they are still forced to unrealistically qualify at rates approaching eight per cent. Following their most recent round of consultations, the Office of the Superintendent of Financial Institutions should have eliminated this qualification rule for those renewing their mortgages with a different institution.”

TRREB President Paul Baron:

“Record population growth and a relatively resilient GTA economy have kept the overall demand for housing strong. However, more of that demand has been pointed at the rental market, as high borrowing costs and uncertainty on the direction of interest rates has seen many would-be home buyers remain on the sidelines in the short term. When mortgage rates start trending lower, home sales will pick up quickly.”

Thanks, as always, for reading. Please do drop us a line anytime with your questions… and comments - good, bad or ugly…!

Andrew.

Questions? Comments? Drop us a line!…

Set Up Your Own Customized SmartSearch

What's your property worth today?

JustBungalows.com Home Page

Questions? Comments? ...We'd  to hear from you!

to hear from you!

Browse GTA Bungalows by City / Region:

Durham Region | Halton Region | Peel Region | Simcoe County | Toronto by Boroughs | York Region

Browse "Beyond the GTA" Bungalows by City / Region:

Brant & Brantford Township | Dufferin County | Grey County | Guelph & Wellington County | Haldimand County | Haliburton County | Hamilton [City] | Hastings County | Kawartha Lakes | Kitchener-Waterloo & Cambridge | Muskoka District | Niagara Region | Northumberland County | Parry Sound District | Peterborough City & County | Prince Edward County